Introduction

Message from the Leader

This guide outlines important information about your Council Tax and Business Rates, and how your money is used to deliver services across Bath & North East Somerset.

It outlines our spending plans for 2024 to 2025 together with the charges for town and parish councils, the police and fire services, and the Environment Agency’s levy for flood protection.

This year we again face significant challenges with spiralling costs caused by inflationary pressures and an increase in demand for our services, particularly in Children’s Services. Whilst we appreciate the impact the rising cost of living is having on many people, we’ve had to raise Council Tax to protect frontline services, especially for our most vulnerable, and to balance our finances.

We’ve managed our finances well and, through additional savings and increasing our income, we are confident the majority of residents won’t notice any change to the services they rely on.

Over the next twelve months we also plan to continue investing in improving people’s lives, including:

- keeping our communities clean and green

- securing more affordable homes through our Council Housing programme

- continuing our Liveable Neighbourhoods programme

- providing more support for children with special educational needs and disabilities

- supporting more sustainable transport, making it easier and safer for more people to walk or cycle, including funding for the Scholar’s Way link in Bath

- delivering local highway improvements, focusing on residents’ priorities such as pedestrian safety

While we appreciate the pressure on household finances, we have decided to extend the community contribution scheme for 2024-25. Contributing is entirely a matter of choice. Anything you do contribute is separate from your Council Tax, and you can donate more than once. The minimum contribution is £5, and there is no maximum.

The application process for grants is run by the council but the money is not used to supplement council services. If you would like to contribute or want more information, visit our web page or type ‘bathnescommunity contribution’ into your search engine.

This is your council and we’re committed to giving you a bigger say in what the council does and how we spend your Council Tax money. Over the past year hundreds of people have taken part in our online consultations. They are your chance to have your say on the issues that matter to you, and I can assure you we listen very carefully to your views before making our decisions. To take part in our consultations, please visit our Have your say pages.

Discovery Card is free for all residents in Bath and North East Somerset and it gives free entry to the Roman Baths, Victoria Art Gallery, and Parade Gardens, as well as access to exclusive discounts at visitor attractions, restaurants, leisure activities and other experiences across the region throughout the year. Read more and apply for your Residents’ Discovery Card now.

Councillor Kevin Guy, Leader Bath & North East Somerset Council

Council Tax and your bill

Council Tax helps pay for local services provided by the council including education, highways, social care, public health, libraries, recycling and waste collections, street lights and much more. The money you pay also funds the police and fire and rescue services and supports town and parish councils.

The amount of Council Tax you pay is based on the valuation band of your property and any discounts or exemptions you may be entitled to.

Due to increasing demand for services and rising costs caused by inflationary pressures we have increased our share of Council Tax in 2024 to 2025 by 4.99%, including 2% ringfenced for Adult Social Care.

This means the Bath & North East Somerset Council element of the Council Tax for a band D property for 2024 to 2025 is £1,736.42, an increase of £82.52, or £1.59 per week.

With precepts added for the Police and Crime Commissioner, Avon Fire Authority and parishes, the average total Council Tax for a Band D property in 2024 to 2025 is £2,155.39.

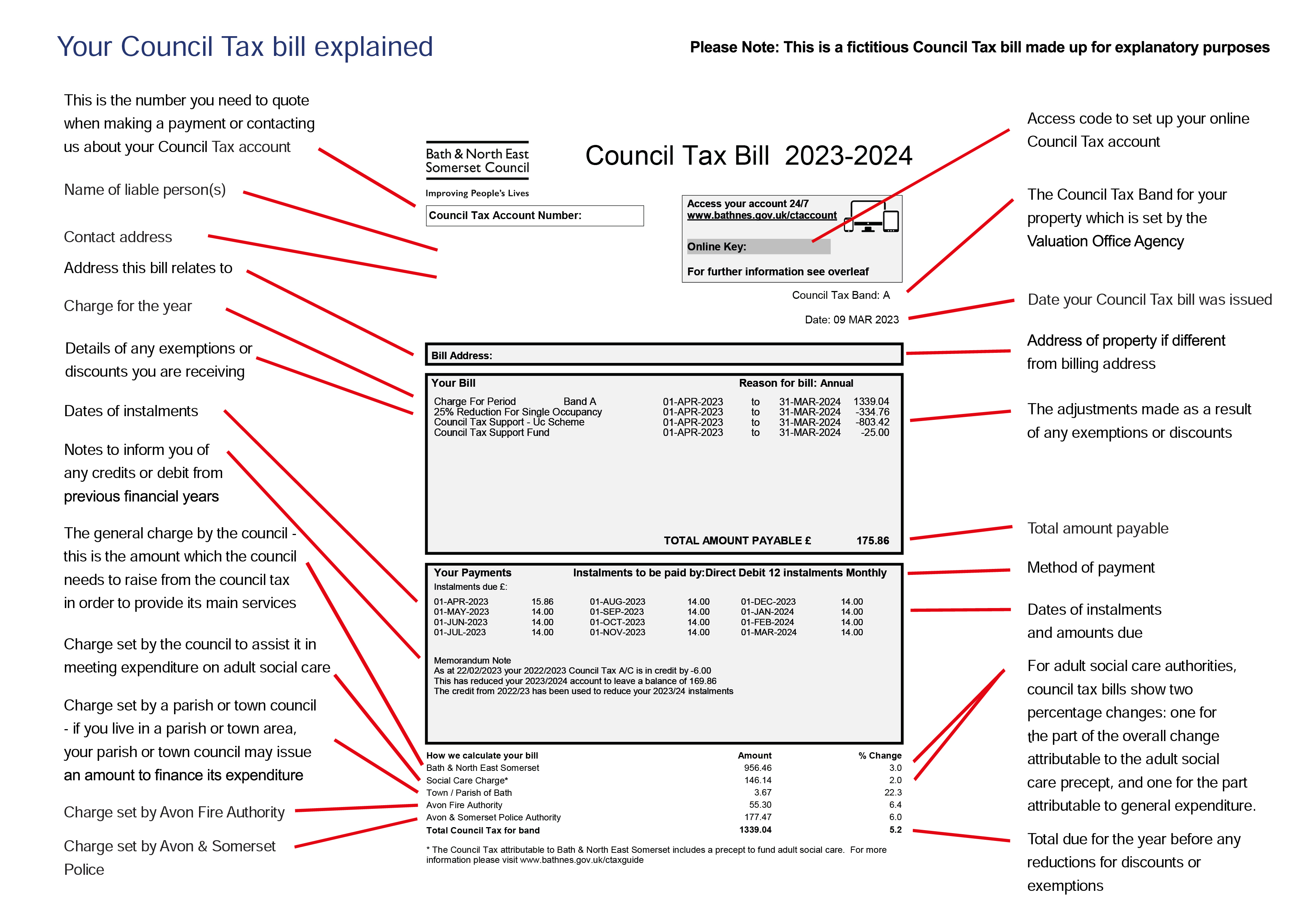

Your Council Tax bill explained

Example Council Tax bill 2024 to 2025

Paying your Council Tax

There are several ways you can pay your Council Tax, and you can find out more on our paying your Council Tax webpage.

If you are struggling to pay, please contact our Council Tax team as soon as possible to discuss your options.

Council Tax discounts and exemptions

In some circumstances you may be able to apply for a Council Tax discount or exemption.

Council Tax Support and Housing Benefit enquiries

If you are on a low income, you may be eligible for Council Tax Support. You may be able to apply for this even if you already receive other Council Tax discounts and exemptions.

In 2024/25 we are introducing changes to the Council Tax Support rules for people who receive Universal Credit. If this means that you cannot afford to pay your bill, the Welfare Support team may be able to offer a discretionary payment.

Manage your Council Tax online

You can switch to paperless billing and manage your Council Tax online.

You’ll need your Council Tax account number, which you can find in the top left corner of your bill. During setup, you will also need to answer some security questions. Having your online key to hand will make this process quicker. Your online key can be found on the top right corner of your bill.

If you can't find your account number, you can use our online form to contact us.

Reporting changes in your circumstances

If you receive a discount, exemption or Council Tax Support, any change in your circumstances, including moving out of the property, could affect your entitlement. You have a legal duty to tell us within 21 days or you may incur a penalty charge.

You can use our online form to tell us about a change in your circumstances

Appeals

There are two areas that you can appeal.

Council Tax banding

If you think your house is in an incorrect Council Tax band you should contact the Valuation Office Agency. You still need to pay your Council Tax whilst waiting for the appeal decision.

Council Tax charge

You can appeal if you think you are not liable to pay Council Tax because:

- you are not the owner or resident

- your property is exempt

- you think there has been a mistake in the calculation of your bill

Please contact us to make an appeal.

Precepts (payments for essential services)

Your Council Tax bill also includes precepts for:

- Adult Social Care

- the police

- the fire service

- town and parish councils

Adult Social Care precept

The Adult Social Care precept allows councils who provide social care to adults to charge an additional amount for Council Tax.

The charge is not linked to whether or not taxpayers receive social care services. If you already pay for care services, the precept does not replace these charges. This charge is shown as a separate line on your bill.

Emergency Services

In 2024 to 2025 Avon and Somerset Police and Crime Commissioner charges have increased by £13 for an average Band D property. Download or view the leaflet.

Avon Fire Authority have increased their Council Tax charge by 2.99%. You can view the details on their website.

Town and parish councils

Town and parish councils across Bath and North East Somerset set their budgets independently, and while the average charge for 2024 to 2025 for a Band D property is £54.34, the charges range from £0 to £174.91.

Business Rates

Business Rates (or non-domestic rates) are taxes paid on non-domestic properties to help towards the cost of local services.

You can find out more about Business Rates on our web pages.

Our budget

For 2024 to 2025 we have set a net budget of £135,853,777. Our share of your Council Tax bill is increasing by 2.99% plus an additional 2% for Adult Social Care, in line with government limits.

The 2024 to 2025 budget also includes £6.51m of additional income, and £9.91m in savings which are designed to deliver a balanced budget.

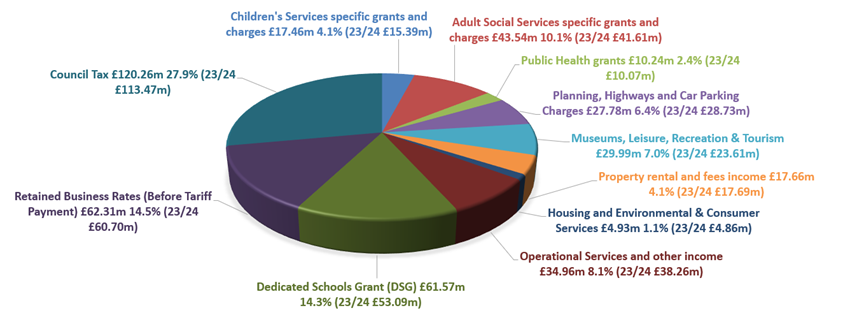

The pie chart and table below show where we will obtain our funding for 2024 to 2025.

Where the money comes from to pay for all the services

Where money comes from to pay for all the services

| £17,464,091 |

4.1% |

£15,388,075 |

| £43,544,076 |

10.1% |

£41,609,774 |

| £10,237,478 |

2.4% |

£10,068,685 |

| £27,781,647 |

6.4% |

£28,730,270 |

| £29,987,594 |

7% |

£23,607,594 |

| £17,655,971 |

4.1% |

£17,692,971 |

| £4,933,968 |

1.1% |

£4,857,968 |

| £34,963,954 |

8.1% |

£38,264,989 |

| £61,572,173 |

14.3% |

£53,090,140 |

| £62,307,956 |

14.5% |

£60,699,414 |

| £120,257,295 |

27.9% |

£113,473,980 |

| £430,706,203 |

100% |

£407,483,860 |

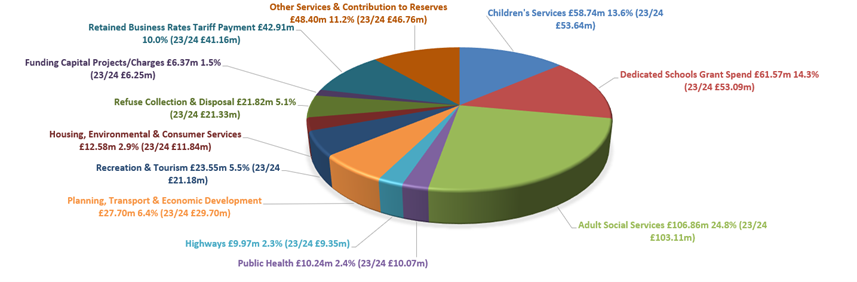

The second diagram and the table below it show our revenue budget for 2024 to 2025. This is our gross spend before taking into account income.

Gross spend before taking account of income

Gross spend before taking account of income

| £58,743,643 |

13.6% |

£53,643,450 |

| £61,572,173 |

14.3% |

£53,090,140 |

| £106,863,071 |

24.8% |

£103,108,607 |

| £10,237,478 |

2.4% |

£10,068,685 |

| £9,968,168 |

2.3% |

£9,353,201 |

| £27,699,752 |

6.4% |

£29,704,695 |

| £23,548,175 |

5.5% |

£21,176,059 |

| £12,580,243 |

2.9% |

£11,838,866 |

| £21,820,234 |

5.1% |

£21,329,795 |

| £6,366,066 |

1.5% |

£6,249,066 |

| £42,905,419 |

10% |

£41,160,148 |

| £48,401,781 |

11.2% |

£46,761,148 |

| £430,706,203 |

100% |

£407,483,860 |

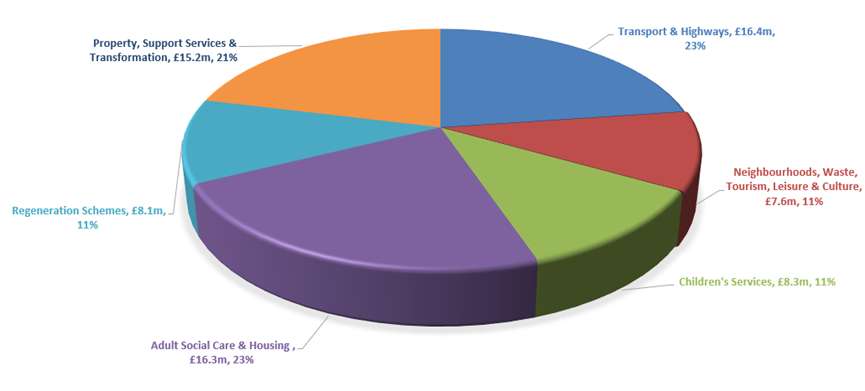

This final diagram and table below show our full approved capital spend of £71.9 million for 2024 to 2025.

Fully approved capital spend 2024 to 2025

Capital Budget 2024 to 2025: Fully approved spend

| £16,400,000 |

23% |

| £7,600,000 |

11% |

| £8.300,000 |

11% |

| £16,300,000 |

23% |

| £8,100,000 |

11% |

| £15,200,000 |

21% |

| £71,900,000 |

100% |

Why spending has increased

We have set our net revenue budget for 2024 to 2025 at £135,853,777. This represents an increase of 3.7%. The build-up is shown below.

Net Revenue Budget 2024 to 2025

| £131,025,622 |

| £6,687,318 |

| £11,851,512 |

| £4,315,000 |

| -£1,606,678 |

| £152,272,774 |

| -£16,418,997 |

| £135,853,777 |

Summary of Band D Council Tax charge

Band D Council Tax charges 2024 to 2025

| £1,484.14 |

2.99% |

| £252.28 |

2% |

| £279.20 |

4.88% |

| £85.43 |

2.99% |

| £54.34 |

10.81% |

| £2,155.39 |

5.03% |

Our Council Tax Requirement (excluding Police, Fire & Parishes) for 2024 to 2025 is £120,257,295, and including Parishes is £124,020,451.

Adult Social Care precept

The Secretary of State made an offer to adult social care authorities.

The offer was the option of an adult social care authority being able to charge an additional “precept” on its Council Tax without holding a referendum, to assist the authority in meeting its expenditure on adult social care from the financial year 2016 to 2017. It was originally made in respect of the financial years up to an including 2019 to 2020. If the Secretary of State chooses to renew this offer in respect of a particular year, this is subject to the approval of the House of Commons.

How your money is spent

Where each £1 of your Council Tax goes in 2024 to 2025

| 81p |

| 13p |

| 4p |

| 2p |

The following information shows where every £1 of Bath & North East Somerset Council’s Council Tax is spent. This is based on net spend after deducting income generated by services and grants including the Dedicated Schools Grant.

46.6p

In the past year Adult Social Care facilitated care and support for 2,460 individuals and enabled 780 people to stay safe in the community. 660 people were supported to return home after a stay in a hospital. We supported 1550 people to live independently in their own homes and access a personal budget to give them choice over how their care is provided. 300 people managed their care through a direct payment. In addition, we supported 1000 people who care for a relative or a loved one.

We also directly run three residential care homes, five extra care housing schemes, and provide home improvement services such as aids and adaptations.

13p

We provide comprehensive weekly kerbside recycling collections, collecting a wide range of recyclable materials from households including:

- food

- glass

- paper and cardboard

- plastics

- small electricals

We collect rubbish every other week from the majority of households and provide a fortnightly collection of garden waste (for a charge). We operate three recycling centres and 268 communal mini recycling centres for flats. We also provide a trade waste collection, recycling, and disposal service. In 2022 to 23 we sent for re-use, recycling, or composting almost 57% of all the household waste we dealt with.

5.6p

Each year our Housing team assists around 2,500 households and allocates approximately 550 social housing lettings. Over the past year we have helped 531 households to avoid homelessness and improved 510 properties. We have also delivered 2,330 affordable homes since 2011. Our Public Protection teams play a vital role in encouraging economic prosperity and community wellbeing by the provision of advice, education, and enforcement of appropriate environmental and consumer legislation.

30.4p

We ensure school places for around 25,000 pupils in 81 schools and academies locally, and fund home to school transport and support services for schools. We assess, fund, and commission a range of services to meet the needs of children and young people with SEND (special educational needs and disabilities). We also fund and provide children’s centre services and the full range of social care services (assessment, planning and intervention) for more than 1,000 of our most vulnerable young people and care leavers. We commission support services across the third and voluntary sector to support us in meeting the needs of our most vulnerable children, young people, and families. We’ve developed the care leaver exemption and foster carer discount.

7.3p

We are responsible for more than 1,102 kilometres of highway and ensuring our network keeps moving. We develop, maintain, and improve highway infrastructure, deliver sustainable transport solutions, improve safety and manage public rights of way for all forms of transport. Each year we resurface miles of carriageway, ensure gullies are debris free, grit key routes across the district in the winter months and maintain traffic signals and streetlights.

We also manage and enforce more 5,863 parking spaces and three Park & Ride sites as well as the first Clean Air Zone outside of London. We provide safe transport for over 2,500 school children and work with our partners in the West of England Combined Authority (WECA) to fund non-commercial bus services, community transport schemes, and shared-taxi schemes.

We deal with around 1,100 building regulations applications and 2,600 planning and listed building applications each year. We develop planning policy framework for the district and make sure we protect what is most valuable to us. We promote the district as a great location for investment, encouraging regeneration and growth. We provide services to help people start and grow their business successfully and support residents to gain skills and progress their careers.

-2.9p

The balance of -2.9p includes significant income relating to our Commercial Estate and Heritage Services, together with funding for services including:

- libraries

- cemeteries

- recreation

- tourism

- cleansing

- funding capital projects and charges

Parish & town council precepts

The Council Tax charges shown below relate to the charge for the parish council, town council, or Charter Trustee element only.

Parish council, town council, or Charter Trustee element charges

| £180,301 |

£198,266 |

£6 |

| £28,500 |

£29,700 |

£38.62 |

| £105,260 |

£124,575 |

£108.13 |

| £31,575 |

£36,950 |

£43.44 |

| £24,240 |

£25,519 |

£96.63 |

| £5,000 |

£5,000 |

£22.08 |

| £2,900 |

£3,500 |

£51.52 |

| £36,000 |

£38,500 |

£57.01 |

| £22,000 |

£23,000 |

£47.95 |

| £2,500 |

£2,500 |

£34.41 |

| £61,191 |

£64,468 |

£102.31 |

| £9,792 |

£9,792 |

£106.07 |

| £14,318 |

£11,069 |

£35.96 |

| £22,000 |

£22,000 |

£86.20 |

| £11,623 |

£14,360 |

£73.51 |

| £10,012 |

£12,506 |

£52.19 |

| £15,152 |

£16,000 |

£47.67 |

| £10,000 |

£10,000 |

£70.10 |

| £48,500 |

£35,000 |

£66.76 |

| £13,685 |

£14,333 |

£42.93 |

| £35,854 |

£38,103 |

£118.81 |

| £35,500 |

£39,000 |

£45.93 |

| £10,776 |

£11,458 |

£78 |

| £18,630 |

£19,812 |

£83.80 |

| £2,500 |

£2,500 |

£28.29 |

| £697,894 |

£758,038 |

£105.84 |

| £8,000 |

£10,500 |

£53.89 |

| £469,190 |

£558,734 |

£136.38 |

| £12,236 |

£12,893 |

£71.81 |

| £5,000 |

£6,100 |

£53.89 |

| £8,099 |

£10,177 |

£137.08 |

| £0 |

£0 |

£0 |

| £4,000 |

£4,000 |

£36.13 |

| £276,894 |

£301,776 |

£144.07 |

| £251,452 |

£337,995 |

£156.63 |

| £7,457 |

£7,829 |

£63.15 |

| £23,744 |

£25,000 |

£49.59 |

| £280,628 |

£309,445 |

£174.91 |

| £49,534 |

£56,320 |

£30.69 |

| £10,522 |

£11,048 |

£62.77 |

| £16,093 |

£19,450 |

£58.99 |

| £750 |

£750 |

£18.03 |

| £18,936 |

£19,694 |

£59.18 |

| £25,100 |

£28,000 |

£40.56 |

| £3,700 |

£4,000 |

£31.20 |

| £39,518 |

£42,769 |

£78.30 |

| £88,000 |

£102,000 |

£106.42 |

| £14,923 |

£15,455 |

£85.98 |

| £16,040 |

£16,040 |

£62.16 |

| £12,225 |

£12,750 |

£54.41 |

| £225,148 |

£240,802 |

£124.92 |

| £42,000 |

£43,680 |

£63.77 |

| £3,364,893 |

£3,763,156 |

|

Town and parish councils spending more than £140,000 are required to provided more detailed information on their budgets:

Other levies on us

Wessex Regional Flood and Coastal Committee charge a levy on us of £262,071 for the coming year. This is an increase from 2023 to 2024 of £4,145. View their demand letter.

If you need further advice or are unable to print this document and require a hard copy, you can contact us using our online form.